4.7 Inventory management

The terms ‘inventory’ and ‘stock’ are often used interchangeably, but both refer to a business’s resources. Nearly all businesses have an inventory of raw materials, work-in-progress and finished goods, as well as information resources and customers. In the case of service-based businesses, queues of customers represent customer inventory. For goods-based businesses the warehousing and care of inventory can be very expensive. Inventory may account for 30 to 50 per cent of the total assets of the business. Therefore, inventory management and control becomes a very important procedure. Controlling the level of inventory in a business is important because the business must hold enough stock to meet demand, but not too much. Too much inventory will increase storage costs, while not having enough stock on hand will result in lost sales and potentially damage the business’s reputation as a reliable supplier. Ultimately, a business will need to balance its inventory expenses with the need to meet changing demand. Technology has made inventory management much more efficient and accurate. Many businesses use barcodes and electronic barcode readers to keep track of what they have, what has been sold and the exact location of stock.

Businesses monitor and control inventory levels so that they:

- do not accumulate dead stock (stock that is old, out of date or unable to be sold)

- can identify slow-moving stock for discounting and deletion

- can maximise the sale of fast-moving items

- can identify stock losses from theft, expiration or damage.

Inventory management involves making decisions regarding how much stock to have on hand at any one time and the most appropriate systems of storage and methods of handling. Management takes into account such factors as:

- the time needed for various supplies to be delivered

- cartage and freight costs

- perishability or life span of the product and its components

- seasonal patterns in demand

- insurance premiums

- costs of handling and packaging.

In order to have the ideal level of inventory, an operations manager will consider the following questions:

- At what stage of the life cycle is the business?

- At what stage is the product life cycle?

- What is the trend in the size of the market – growing or shrinking?

- What is the inventory turnover? Is the product a low-profit-margin, fast-selling item or a high-profit-margin, slow-selling item?

- How perishable is the product? What is its use-by date?

- How much storage space is available and what is required?

- What types of funds are used to finance the purchase of the stock? Can the business reduce financial costs by using commercial bills or other forms of debt finance with a longer term than an overdraft business credit card?

- Will there be enough staff to manage the delivery and storage?

- What security or special storage requirements are needed?

Inventory management can be as much an art as a science. Managers will use their past experience, and knowledge of the business and the market to hold as efficient a level of stock as possible. However, sophisticated software programs and computerised inventory management systems that can update records, generate orders and forecast demand have made inventory management much more precise.

Advantages and disadvantages of holding stock

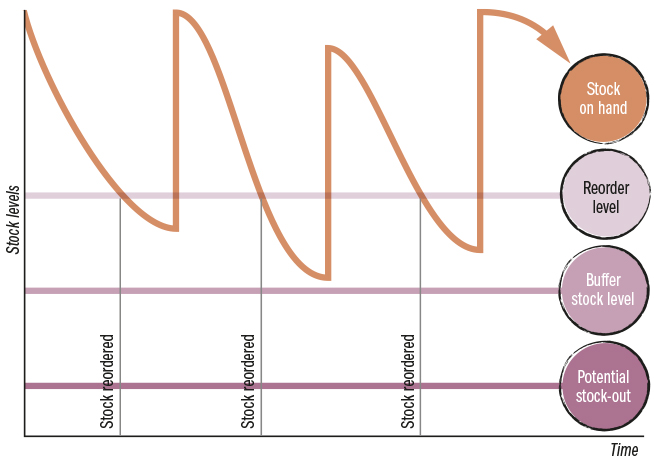

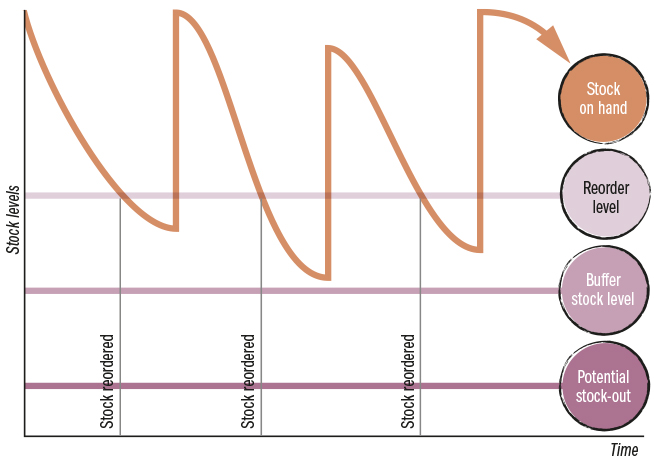

Holding stock is also known as buffer stock. Using this method, a business holds a certain level of stock as a reserve to cover interruptions to supply or an unexpected increase in demand. The advantage for cash flow is that stock is ordered at more regular intervals, which reduces the pressure on the business to have a higher amount of cash readily available. Purchases can be planned so that working capital is managed more efficiently. There is usually a certain pattern to sales over the year with predictable changes. For example, more stock will be ordered prior to Christmas for a toy store and less during January and February. Holding stock also suits suppliers that need a longer lead time (the time it takes between when a supplier is notified and stock is actually delivered).

Other advantages of holding stock include:

- stock being ready to use as inputs or to sell

- no need to rely on suppliers for just-in-time deliveries

- opportunity for discounts when ordering stock in bulk

- ability to take advantage of a growing market domestically and overseas

- inputs and components that are able to be used as spare parts if required.

Overall, holding stock is conservative inventory management and it does keep valuable finance tied up in stock. There are warehouse expenses for storage and security. There is also the risk that inventory may become obsolete. For example, one of the causes of the failure of Dick Smith Ltd in 2016 was that the business was carrying excessive levels of older stock which was not selling fast enough and therefore becoming obsolete with technological developments in consumer electronics. The value of Dick Smith’s inventory was falling while its inventory management costs were higher than its competitor, JB Hi-Fi.

Perishable items such as food, if held for too long, can spoil. A business may have to sell stock at a large discount to recover cash if it experiences a cash-flow crisis. When there is not enough stock on hand a business may experience a stock-out, in which there is no supply of stock available for customers. Customers may switch to a competitor as a result.

Overall, the challenge for inventory management is to have enough stock on hand to satisfy changes in customer demand and not be overstocked, so that costs can be minimised. This will give a business a competitive advantage because it contributes to efficient operations, which provides for lower prices, and customers will always be satisfied as products will be available on demand.

LIFO

LIFO literally means ‘last in, first out’; that is, the stock purchased most recently is sold first. This method can be used for goods that have no use-by date, such as machinery parts. The LIFO system is actually an accounting method of recording inventory costs and the reality of inventory management may be quite different from calculating costs for the financial statements. This is because costs for inventory will change over a year due to newer stock being more expensive than stock purchased at the start of the year.

FIFO

‘First in, first out’ (FIFO) assumes that the first stock that has been purchased is the oldest and will be sold first. FIFO is more appropriate for perishable items such as food and drink. Imagine a supermarket where the oldest stock that has to be sold before it reaches its use-by date will be placed at the front of the shelf and new stock will be placed behind, ready to replace it as it sells. Using FIFO, the business assumes that the oldest goods are sold first and the items obtained most recently stay in inventory on the balance sheet. The impact of this cost accounting method is that closing stock on the balance sheet has a higher value, increasing the value of current assets. Cost of goods sold will be lower and gross profit will be higher than if the LIFO method was used.

JIT

The aim of just-in-time (JIT) inventory management is to hold as little stock as possible and only bring in stock from suppliers as required. Only the exact number is delivered at a specific time. This not only reduces the impact on working capital with less liquidity locked up as inventory, but should also improve the efficiency of the whole operations process. This system requires suppliers to have excellent inventory management and delivery systems to send out stock as soon as it is ordered. Sophisticated scheduling software to plan production is used to order the correct stock. EDI is used to share information between suppliers and customers, which helps to ensure mistakes are not made.

The advantages of JIT are:

- reduced costs of storage and securing stock

- increased liquidity of working capital as less cash is tied up as stock

- reduced chances of stock becoming obsolete and unsellable

- reduced chances of perishable stock spoiling (for example, fresh fruit)

- less warehouse space, allowing more room for other activities

- less time spent on checking products, as without extra work in progress the production process must get it right the first time.

However, as supply is outsourced there is a further disadvantage that, if a supplier experiences a problem and stock is not delivered on time, the entire production schedule is disrupted.

Overall, JIT gives a business more flexibility to respond to a changing market and other external influences that can affect sales. However, a business must have reliable and dependable suppliers who can respond to the business’s inventory needs quickly.