19.5 Building up your superannuation

The concept of retirement seems such a far-off occurrence for people who are just entering the workforce. However, those who have been working for over 40 years are nearing the time when they are considering retirement from the paid workforce. Important in their minds is: ‘Do I have sufficient money to retire on and to live the life I want to live?’ The Association of Superannuation Funds of Australia (ASFA) states that a single person needs to be earning an annual income of $39 852 and a couple needs $54 562 to live comfortably during retirement, assuming they fully own their own home.

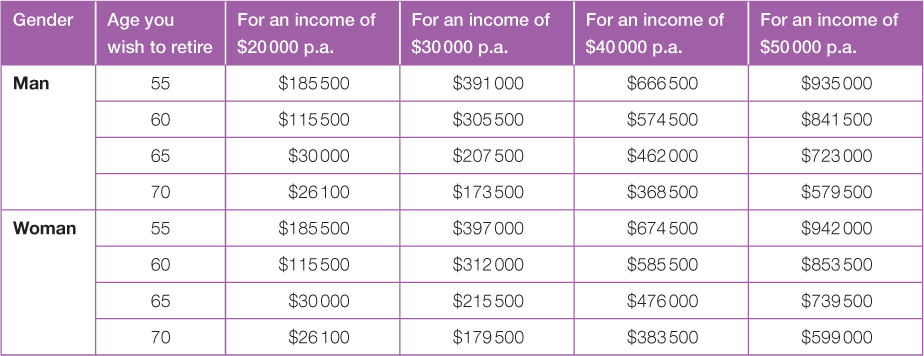

It is the aim of most people to be financially independent in their retirement years, but trying to estimate how much superannuation you will need to fund your retirement is very difficult. Source 19.19 sets out an estimate from REST Industry Super, which shows that the amount of superannuation you will need depends on the age you want to retire and how much income you expect you will need to live on in your retirement years.

| Gender | Age you wish to retire | For an income of $20 000 p.a. | For an income of $30 000 p.a. | For an income of $40 000 p.a. | For an income of $50 000 p.a. |

|---|---|---|---|---|---|

| Man | 55 | $185 500 | $391 000 | $666 500 | $935 000 |

| 60 | $115 500 | $305 500 | $574 500 | $841 500 | |

| 65 | $30 000 | $207 500 | $462 000 | $723 000 | |

| 70 | $26 100 | $173 500 | $368 500 | $579 500 | |

| Woman | 55 | $185 500 | $397 000 | $674 500 | $942 000 |

| 60 | $115 500 | $312 000 | $585 500 | $853 500 | |

| 65 | $30 000 | $215 500 | $476 000 | $739 500 | |

| 70 | $26 100 | $179 500 | $383 500 | $599 000 |

To assist us to lower our risk of not having sufficient funds for an enjoyable life in retirement, a compulsory superannuation guarantee system was introduced by the federal government in 1992. Before this, most workers were not covered by any superannuation scheme and relied upon drawing an age pension from the government to fund their retirement years. With the ‘baby boomers’ (those born after World War II) getter closer to retirement and therefore potentially putting pressure on the Australian economy for pension payments, the government decided that a reform package which incorporated compulsory superannuation would be introduced. The reform package set up a means-tested government age pension system, compulsory contributions to superannuation by employers and voluntary savings by employees to their superannuation and other investment options.

An employee who earns more than $450 per month, works more than 30 hours per week (full-time, part-time or casual) and is not more than 70 years old will receive in their nominated superannuation fund an employer contribution at the rate of 9.25% (in 2014) of their current wage or salary. The employer is legally obliged to pay these contributions (the Super Guarantee) into the employee’s nominated fund at least every 3 months. The Super Guarantee is set to gradually increase and will eventually require an employer to contribute 12% on behalf of their employee. The monies held on behalf of an employee in the nominated superannuation fund can also be topped up by the employee’s own contributions and are a very good way to save for retirement. Over the period of your working life, the super money is accumulating and will become a sufficient amount to live off in retirement. The federal government also provides advantageous taxation treatment for contributions made by employees into their superannuation fund; this is referred to as ‘salary sacrificing’.

Australia is ranked fifth in the list of best places to retire. It is ahead of the USA and the UK.

There are many superannuation funds operating in Australia that employees may choose to join. They fall into five main groups:

- industry funds, which are run by employer associations or unions for the benefit of their members, such as REST Industry Super (Retail Employees Superannuation), AMIST My Super, Australian Catholic Superannuation & Retirement Fund, VicSuper and Cbus

- wholesale master trusts, which are operated by financial institutions for groups of employees, such as AMP My Super and Tailored Super

- retail master trusts/wrap platforms, which are funds run by financial institutions for individuals, such as Commonwealth Bank Super Mix 70 and the Super Directions Personal Super Plan

- employer funds, which are established by employers for their employees and have their own trust structure, such as Telstra Super Balanced Fund and BHP-Billiton My Super

- self-managed superannuation funds (SMSFs), which are established for a small number of individuals (up to four members) and regulated by the Australian Taxation Office (ATO).

DEVELOPING YOUR UNDERSTANDING 19.5

Access the Australian Taxation Office website at www.cambridge.edu.au/hass9weblinks to help you to complete the following tasks:

- Outline the current taxation advantages available to people (of different ages) who wish to contribute additional amounts to their superannuation fund.

- Calculate the rate of payable taxation when retired people wish to withdraw funds from their superannuation fund.