19.4 Financial risks to be aware of and protect against

Unfortunately there is a range of risks that individuals need to be aware of and that can negatively impact on their financial management strategies.

Becoming a victim of scams

A scam is a strategy that some people use to steal money or identity from unsuspecting people. The scammers contact their victims with offers that seem too good to be true. They typically involve giving some money in exchange for a promise to receive a much bigger sum of money in return. This is always a good question to ask yourself, ‘Does this sound too good to be true?’ If you answer ‘yes’, then great care should be taken before parting with any of your money.

The schemes used by scammers vary over time and are generally cleverly disguised. Here are some of the current scam types:

- online scams (email) or personalised letter scams

- lottery and competition scams (fake prizes)

- investment scams (get-rich-quick schemes)

- pyramid schemes and door-to-door selling scams

- identity theft scams (phishing)

- job and employment scams

- mobile phone scams

- banking and online account scams.

Scams are fraudulent and are performed by dishonest individuals, groups or companies who attempt to gain money or something of value. Over time, scams have evolved from the early days of relying on tricks of confidence, where an individual would misrepresent themselves as someone with skill or authority, such as a doctor, lawyer or stockbroker. The internet, however, has changed the scene and we are seeing new forms of scams emerging: lottery scams, scam baiting, email spoofing, phishing or requests for help to name a few. These are all considered to be email fraud.

More than 200 cases of shopping and trading scams were recorded by Consumer Affairs Victoria in 2012, including cons where scammers advertised fake goods to trick consumers into sending money and used fake cheques to buy from genuine sellers. The consumer advocacy group Choice says that if a website is unfamiliar, shoppers should research the company, read buyer reviews, call the contact number and check the refund, returns, privacy, delivery and guarantee policies.

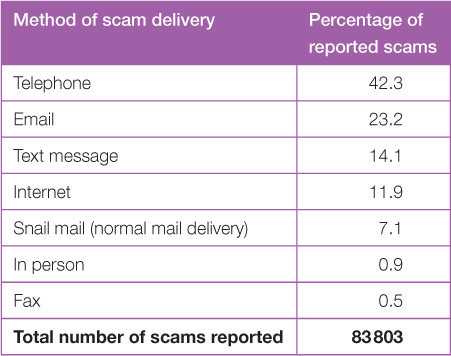

In an effort to help individuals lower their risk of being scammed, governments at both federal and state levels have created websites to help fight scams and cybercrime; they recommend that people use these websites to gain information on how to avoid being scammed and also report scams so that others are not then affected. The Australian Competition and Consumer Commission’s report stated that in 2012 $93 million was reported lost to scams in Australia.

The international reporting site for online scams is that of the International Consumer Protection and Enforcement Network (ICPEN) – find it at www.cambridge.edu.au/hass9weblinks.

| Method of scam delivery | Percentage of reported scams |

|---|---|

| Telephone | 42.3 |

| 23.2 | |

| Text message | 14.1 |

| Internet | 11.9 |

| Snail mail (normal mail delivery) | 7.1 |

| In person | 0.9 |

| Fax | 0.5 |

| Total number of scams reported | 83 803 |

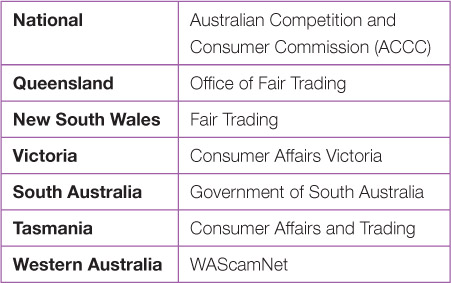

To further assist consumers, every state in Australia has a website for reporting scams (see the table below). Find them at www.cambridge.edu.au/hass9weblinks.

| National | Australian Competition and Consumer Commission (ACCC) |

| Queensland | Office of Fair Trading |

| New South Wales | Fair Trading |

| Victoria | Consumer Affairs Victoria |

| South Australia | Government of South Australia |

| Tasmania | Consumer Affairs and Trading |

| Western Australia | WAScamNet |

Becoming a victim of identity theft

Money is not the only thing that scammers are after – often they want to actually steal your identity. Scammers endeavour to find out personal information about you such as where you live, whether you have a credit card, where you bank and whether you have a current passport.

These types of scams are classified as ‘identify theft’. The personal details the scammer obtains could then be used in scams such as card skimming, phishing, lottery scams, money transfer scams and work from home scams.

The Australian Competition and Consumer Commission (ACCC) through its SCAMwatch program advises that scammers are using people’s personal details to take out loans, claim welfare benefits or run up debt in the name of the person from whom they have stolen the identity. If you have been scammed, you may find that your credit rating has been damaged and that it is difficult to get a credit card or borrow money in the future. SCAMwatch also advises that it can be very annoying and time-consuming trying to set the record straight after a scammer has misused your identity.

There are other ways that scammers can steal your identity. For instance, a lost wallet or purse can provide the scammer with a lot of your personal details or even a PIN written down on a piece of paper contained in the wallet. Also, if someone ‘dumpster dives’ in your rubbish bin, they can take your personal details from any discarded mail.

Determined scammers have other elaborate and cunning ways they can trick you into providing your personal details. An example is a request that appears to come (via email) from your bank or telecommunications provider wanting you to clarify your details. These scams are known as ‘phishing’ and try to trick you into handing over your personal banking details to the scammers. It should always be remembered that no bank will ever send an email asking you to follow a link or asking you for your personal details. Also, if you wish to ring the bank do not call using any telephone number listed in the email, but instead go back to a recent bank statement or credit card statement and use that number. Banks are aware of these scams and employ specialised internet security staff to provide assistance.

Making safe online shopping transactions

Online shopping is often the easiest and most convenient way of purchasing goods, but how do you protect yourself from any financial risk using the online environment? It is important that you know about the entire purchasing process – who you are dealing with, exactly what it is that you are buying, how confidently you know that you are getting what you have paid for and also that your account and credit card details are being dealt with safely.

Set out below are some suggested tips to help with making online shopping a safe experience.

Be wary if:

- the website they use is not professional and looks suspicious, creating uncertainty about who you are actually dealing with; contact deals may also be vague

- the description of the product is not clear, with bargain offers that look too good to be true; insufficient details about sizes, colour, value and safety of the product are other clues

- you are not feeling confident about their use of your information

- the fine print relating to refund and complaint handling policies is not all there

- the website is not clear on the final cost and in particular about what extra charges (currency conversion, postage and handling) may be added.

If you decide to go ahead with your online purchase, follow these safety suggestions:

- Only pay via a secure web page (one that has a valid digital certificate). At the beginning of the address bar there should be the letters ‘https’ and a locked padlock in the browser.

- Use a secure payment method such as PayPal, BPay or your credit card. Money transfers and direct debits should be avoided as these can be open to abuse.

- Never send your bank or credit card details via email, only via a secure web page.

- Always print and keep a copy of the transaction.

RESEARCH 19.3

- Discuss with your parents, carers or other family members the types of scams they are aware of. The discussion could include the following questions:

- Have they ever been a victim of a scam?

- How did they come across the scam? (Email, telephone, mail, text message, met a scammer, internet?)

- What was the exact nature of the scam?

- Did they think that the scam was a ‘real offer’?

- Examine their responses compared to what you have learnt about scams. Do they use less technology, and so are less aware of scams?

- Record your findings and present them to the class.

Take care using ATM banking

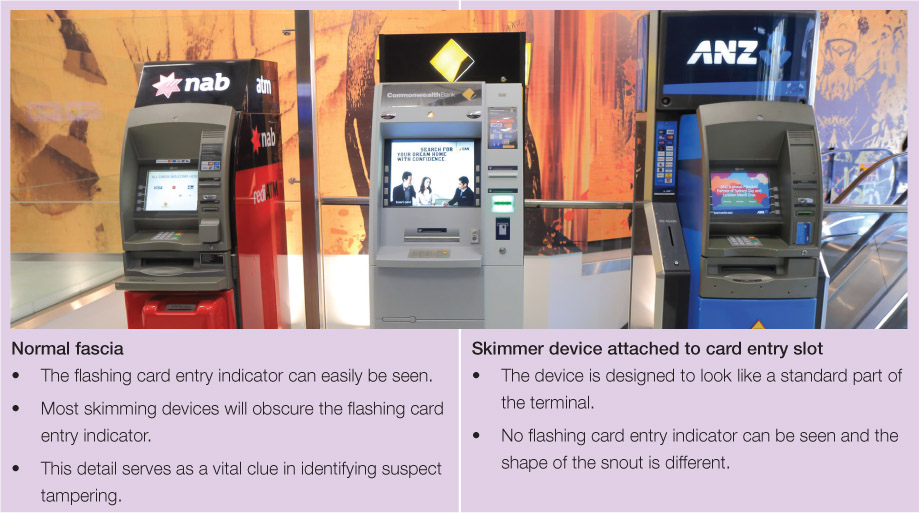

Using your local automatic teller machine (ATM) could come at a shocking cost if you are not careful. The reason is that the practice known as ‘skimming’ may have occurred. Banks and security consultants advise that thieves can without your direct knowledge clear out your accounts. The thieves swipe your credentials by using pirated card readers and pinhole cameras which they mount on the ATMs. The modifications are very hard to detect by the untrained eye. The thieves capture your stripe data and PIN and then produce counterfeit cards. To assist and raise awareness of skimming for their customers, the Commonwealth Bank of Australia has prepared an ATM awareness guide. Find it at www.cambridge.edu.au/hass9weblinks.

There are a number of simple ways to help protect yourself against being ‘skimmed’ when using an ATM:

- Choose ATMs within bank branches or vestibules; these are safer than ATMs in bars or shops.

- Choose places that are well lit and supervised.

- Be observant – look at the ATMs and compare them with each other for any small differences such as loose or crooked areas around the keypad, the card slot and the panels around the machine.

- Cover your PIN entry with your other hand to prevent observers or cameras from capturing your numbers.

- If you see any dodgy transactions in your card statement, immediately advise your bank to avoid further loss.

- Review your bank statements regularly for unusual activity – this helps to prevent ‘long-term withdrawal trend’.

If you find that your card has been ‘skimmed’, you can seek legal protection. Financial institutions in Australia are required to reimburse their customers in the event of unauthorised charges.

In February 2013, a $1 million card-skimming ring was busted when a man in sunglasses triggered attention by using several cards to withdraw large sums of money.

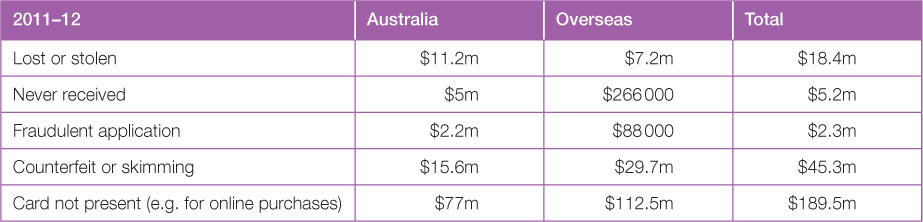

The Australian Payments Clearing Association estimates $262.6 million was lost to credit card theft in the 2011–12 financial year. The Australian Crime Commission estimated losses to be in excess of $113 million between January 2007 and April 2012.

| 2011–12 | Australia | Overseas | Total |

|---|---|---|---|

| Lost or stolen | $11.2m | $7.2m | $18.4m |

| Never received | $5m | $266 000 | $5.2m |

| Fraudulent application | $2.2m | $88 000 | $2.3m |

| Counterfeit or skimming | $15.6m | $29.7m | $45.3m |

| Card not present (e.g. for online purchases) | $77m | $112.5m | $189.5m |

It is essential that personal financial information such as credit cards and ATM cards are kept safe and secure. It is recommended that you do not share your personal identify numbers (PINs) with anyone; also, don’t keep a written copy of your PIN with your card. You should never enter your personal, credit card or online account information on a website (or by email) that you are not certain is genuine. Internet banking is best avoided using public computers at libraries or internet cafes as computer networks at these venues are not always secure. The choice of password is important – make sure you create one that would be difficult for anyone else to guess. Another good protection strategy is to install up-to-date software that protects your computer from viruses and unwanted programs.

Australian consumers spent $444 billion is the amount using their credit and debit cards during 2012–13. This is three times as much as they made in ATM and EFTPOS cash withdrawals.

Make sure you carefully check your credit card and bank statements

If you are using a credit card or debit card it is important that you regularly check your statements. Most banks issue these statements online as they are costly to produce and mail out to customers. Sometimes issues arise with credit and debit card transactions. If you do not recognise the business or retailer itemised on the statement, make contact with them directly to discuss your query. Some of the common types of queries relate to:

- a refund or credit that has not been processed or appears on your statement as a purchase

- a transaction amount on your statement that differs from your receipt

- a regular payment that has been cancelled but you are still being charged

- multiple charges for the same purchase

- goods that were received were not as described

- services that have not been rendered

- merchandise that is defective or was never received.

The credit card statement contains important information for you, such as:

- the due date for payment of your minimum monthly amount – this date is important as it relates directly to interest charges calculated for late or non-payment

- the statement period – this is the actual number of days in the statement period and can vary depending on the length of the month and on which date of the month the account was opened

- the correct account number – there should be only be one account number even if there are multiple cardholders on the one account and each card’s transactions should be checked

- the available credit balance for the statement period, which outlines what credit amount is left to spend on the credit card account at the end of the statement period

- opening and closing balances – the balances at the start and end of the statement period should be checked for purchase transactions, cash advances, transfers, and fees and charges less any payments and refunds.

Should there be any problems detected on the statements, you should immediately take action. Initially contact the merchant directly and if they are not able to rectify the problem, contact the bank, who will follow up the query on your behalf.

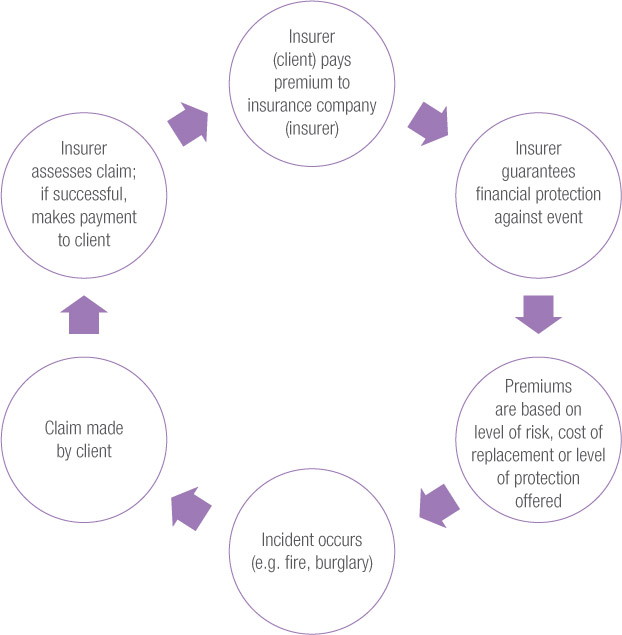

Make sure you have adequate insurance cover

In life we are exposed to all different types of risk in both our personal and working lives. As individuals it is wise to take measures to minimise the levels of risk that everyday situations can provide. Taking out an appropriate form of insurance cover will assist in providing a level of financial compensation to the policy holder in the event of adverse unforeseen circumstances.

Insurance is broken into two main categories – life insurance and non-life (general) insurance. The types of general insurance policies available are numerous, such as:

- general property, home and contents insurance

- motor vehicle insurance

- business insurance including professional indemnity, public and product liability

- mortgage loss insurance (mortgage protection insurance)

- workers’ compensation (WorkCover)

- travel insurance.

Purchasing a home is the largest financial outlay most people will make in their lives, and they will have saved and planned for this purchase for a long time. It is therefore important that all risks associated with owning this asset are identified and that insurance cover is taken out to cover any adverse unforeseen circumstances. Examples of these circumstances could be a fire destroying your house or part of it, a burst water pipe flooding the inside of the house, a lightning strike causing all your electrical appliances to arc and fail, and a burglar cleaning out your house contents and jewellery. The amount a consumer pays for their insurance relates directly to the level of risk associated with the event they want cover for. For instance, if you want to insure your house against burglary, a simple act of installing deadlocks on all windows and doors will reduce your level of risk and ultimately the premium you will need to pay. Over the past couple of decades home owners have become more concerned with both their personal safety and protecting their property. Walking around your neighbourhood you will observe on both houses and commercial buildings sensor lights, alarms, CCTV cameras, security doors and windows, quality locks and high fences and gates.

Different suburbs are also deemed to be ‘higher risk’ areas. On an annual basis police departments in each state compile crime statistics and insurance companies use these when determining the risk levels for both property and car insurance. Also, certain makes of cars are deemed to have higher risk of theft and attract loadings on their insurance premiums. Insurance companies often publish lists which provide the risk ratings of suburbs. It can be an interesting exercise to check how your suburb rates compared neighbouring suburbs or even those across town.

RESEARCH 19.4

Undertake an internet search to determine the burglary rating of the suburb or town in which you live. Find out if the rate of burglaries has increased or decreased. If there has been change in the rate, suggest reasons why this has occurred.

Hint: Check the websites of insurance companies and the police department in your state.

In 1997 the rate of burglary of houses in the inner-city suburb of Richmond (Melbourne) was one in every 19 homes compared to one in 79 in 2013, according to the RACV.

Australia has experienced a range of disasters (cyclones, severe storms, floods and bushfires) over the past few years. Many people following these disasters have been left in dire financial situations because they either did not take out insurance cover at all or had taken out insurance cover but not read the fine print and exclusion clauses. Insurance companies following a claim by the policy holder will determine whether the claim is covered by the policy and how much compensation is payable or if the event is not covered at all. If the policy holder is disputing payment of their claim, they may contact the Financial Ombudsman Service (see www.cambridge.edu.au/hass9weblinks) to review their claim. Insurance companies, like other financial institutions, are regulated by APRA (see www.cambridge.edu.au/hass9weblinks).

Life insurance

Having protected your home and car, it is important that insurance is taken out to protect you and your family. This is referred to as ‘life insurance’ and there are several types of policies that can be taken out:

- Life insurance. This policy will pay a lump sum to your beneficiaries on your death or to you on the diagnosis of a terminal illness. The payout is often used to pay off your outstanding debts and mortgage on your home and help your family to be financially secure.

- Total and permanent disability insurance. A lump sum is paid if you become disabled or are unable to ever work again. This amount is usually used to pay off existing debts, cover your medical expenses (current and ongoing) and pay for any modifications needed to your accommodation or vehicle, with the remainder being invested to help maintain you in future years.

- Income protection insurance. If you become ill or sustain an injury that means that you are unable to work, this policy provides a replacement income of up to 75% of the income you were receiving prior to the illness or accident. It is important to read the policy conditions carefully to determine for what period of time this policy will provide you with replacement income and if any waiting periods apply before entitlement to payment.

- Trauma insurance. This policy will pay a lump sum upon the diagnosis of one of a list of specific illnesses – for example, heart attack, cancer or a stroke. This payment will help you to focus on really taking care of yourself (medical and rehabilitation) and if needed will cover the cost of a carer to assist you in your everyday life activities.

When arranging any form of insurance cover, an assessment is made on your level of risk. For instance, a young, fit and healthy person working in an office job would be assessed as being of lower risk than someone who is obese, a heavy smoker and works as a truck driver or construction worker. The level of risk directly relates to the amount of premium you need to pay.

Private health insurance

In Australia we have a universal health insurance scheme called ‘Medicare’. The scheme was introduced in 1984 with the purpose of providing access to affordable and high-quality health care for all Australians. Medicare provides access to free treatment in public hospitals and free or subsidised treatment by doctors, optometrists or dentists. As taxpayers we contribute to funding this scheme through our taxes and the Medicare levy, which is based on our taxable income (see www.cambridge.edu.au/hass9weblinks).

Many Australians also take out private health insurance to cover a broader range of medical and ancillary service treatment costs than Medicare provides. When deciding to purchase or alter your level of private health insurance, it is important to carefully assess your level of need relevant to yourself (single) or as a family and then to really understand what level of cover is being provided and if there are any waiting periods that must be served before you can make a claim. Private health insurance is very expensive and many people have opted out in recent years due to the increased costs.

There are two types of private health insurance:

- Hospital cover, which covers hospital costs such as your doctor, accommodation (bed) and theatre fees. The level of cover you choose can range from top private hospital cover (which will cover all services where Medicare pays a benefit) to basic private hospital cover where exclusions or restrictions are placed on some medical areas such as cardiac, rehabilitation, psychiatric services and palliative care.

- Ancillary or extra costs cover, also known as general treatment policies, which provides cover for optical, physiotherapy, podiatry, psychology, chiropractic, hearing and dental work.

There are numerous private health funds operating in Australia with varying levels of cover and cost. Due to the high cost of these policies, it is highly recommended that you do research to compare what the difference health funds offer.

Source 19.18a A public information video about the difference between public and private health in Australia. (03:09)

DEVELOPING YOUR UNDERSTANDING 19.4

Access the Private Health website at www.cambridge.edu.au/hass9weblinks and complete the following tasks:

- Complete the comparison test to determine which private health insurance policies would provide you (as a single person) with the cover you require.

- Complete the comparison test to determine which private health insurance policies would meet the needs of your family.