19.2 Types of financial investments available to individuals

Individuals are involved in many transactions that relate to their financial situation. It is important that they understand how to manage their level of financial risk. People want to have the opportunity to gain financial stability, whether through their employment or investments. They also want to feel safe and secure in what they are doing and that they understand and can manage the risk involved when managing their finances. To manage the level of risk it is wise to diversify by spreading your investment across the major ‘asset classes’: cash, fixed interest, bonds, property and shares.

Some people are very conservative in the management of their finances and are said to be ‘risk-averse’ whereas others feel comfortable exposing themselves to a higher level of risk-taking, believing they will ultimately gain more financially. Risk-aversion is an economics and finance concept formed from the behaviour of the consumer and investor while exposed to uncertainty and their attempt to reduce that uncertainty. A person who is risk-averse is reluctant to accept a bargain with an uncertain (possibly higher) payoff rather than another bargain that has a greater level of certainty, but possibly lower expected payoff. For example a risk-averse individual may put their money into a bank account with a low but guaranteed interest rate, rather than into shares that may have high expected returns, but also possess a likely chance of depreciating value.

Shares

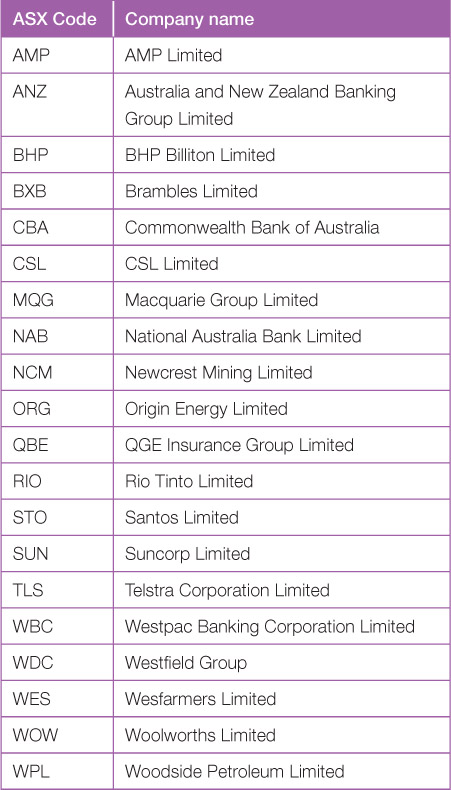

Many individuals, however, do invest in businesses by purchasing shares from companies that are listed on the Australian Securities Exchange (ASX). These shareholders expect to receive both dividends and to gain capital appreciation from their share ownership. It is important that the level of financial risk associated with share ownership is carefully researched. In Australia we often refer to high-quality and usually high-price shares as being ‘blue chip’. A blue chip company is one that is very strong financially, including holding a solid history of producing earnings, and only carries a small to moderate amount of debt. It also has a secure name in its industry with dominant goods or services. Many blue chip companies are large, international companies that have been running for many years and are considered to be very reliable. Source 19.6 sets out the 20 top ranked blue chip stocks (shares) in Australia.

| ASX Code | Company name |

|---|---|

| AMP | AMP Limited |

| ANZ | Australia and New Zealand Banking Group Limited |

| BHP | BHP Billiton Limited |

| BXB | Brambles Limited |

| CBA | Commonwealth Bank of Australia |

| CSL | CSL Limited |

| MQG | Macquarie Group Limited |

| NAB | National Australia Bank Limited |

| NCM | Newcrest Mining Limited |

| ORG | Origin Energy Limited |

| QBE | QGE Insurance Group Limited |

| RIO | Rio Tinto Limited |

| STO | Santos Limited |

| SUN | Suncorp Limited |

| TLS | Telstra Corporation Limited |

| WBC | Westpac Banking Corporation Limited |

| WDC | Westfield Group |

| WES | Wesfarmers Limited |

| WOW | Woolworths Limited |

| WPL | Woodside Petroleum Limited |

DEVELOPING YOUR UNDERSTANDING 19.2

- Create a three-column table using the following column headings: column 1 – ‘ASX code’, column 2 – ‘Company name’, column 3 – ‘Industry sector’.

- Access the ASX website (www.cambridge.edu.au/hass9weblinks) and, using the company’s symbol, determine the industry sector and complete column 3 of the table.

- Choose five of the 20 companies (from different industry sectors). Using the company’s symbol, track the share price and volume movement of the selected companies over a 7-day period.

- Create a spreadsheet for each of the individual company’s share price movement over the 7-day period. Convert this information into either a line or bar graph.

- Identify factors – in particular between the industry sectors – that may have occurred to explain any movement in the share price over the period identified.

The level of financial risk varies according to the debt levels and adequacy of cash flow of the company. The possibility that shareholders may lose money is greater if they invest in a company that has a large amount of debt and the company’s cash flow proves unable to meet its financial obligations. Should a company use debt financing, the level of risk to shareholders (individuals) is higher, as the company’s creditors will be repaid before its shareholders if the company becomes insolvent. The shareholders could end up with shares of little or no value if the company is then wound up. All notices relating to the appointment of an external administrator to a company are published in the insolvency notices website maintained by the Australian Securities and Investments Commission (ASIC). This list is published after a company has been declared insolvent, but by checking this list you may gain some insight into types of companies that are not performing well. You will notice that nearly all these companies are private companies, not listed on the Australian Securities Exchange (ASX). The ASX places stringent requirements on listed companies and will halt their trading or de-list them if they do not comply with its requirements.

Investors can use a number of financial risk ratios to assess an investment’s prospects. It is recommended that potential investors conduct a thorough and careful review of companies before making any investment in them. For example, check the debt-to-capital ratio measures and the proportion of debt used given the total capital structure of the business. The capital expenditure ratio divides cash flow from operations by capital expenditure to examine how much money a company has left after servicing its debt. Two leading businesses which once had over $1 billion market capitalisation, Tasmanian timber company Gunns Limited and Australia’s largest commercial refrigeration company, Hastie Group Limited, recently folded due to overladen debt burdens and cash flow problems.

Some individual investors, as part of their investment portfolio, are happy to accept a greater risk when investing in shares. They may choose to purchase shares in companies that are more speculative, such as resources or mining, in the hope of gaining greater returns on their investment. Their risk of these businesses not becoming profitable is also greater.

When determining your personal financial management, and in particular your investment strategy as an individual, the stage at which you are currently in your life has a great impact on the strategy you adopt. When you are younger you may be more willing to purchase shares that provide greater possibility of improvement in their capital appreciation rather than paying a good rate of return by way of dividend. This is because this is not usually your only form of income. By these shares improving in their share value over time they will give you a greater level of capital appreciation in the event you decide to sell them later on. When a person is older, possibly retired, they are more reliant on the income from their share portfolio and therefore want to hold shares that have a higher yield (dividend payment) rather than capital appreciation.

Many older investors favour holding shares in Telstra, because it has always paid a good rate of return (dividend) while its share value often fluctuates. A popular choice for investors that are looking for both income and growth focus is Wesfarmers. This is a conglomerate (group of companies) with exposure to consumer staples, consumer discretionary and industrial sectors. Under its umbrella group it owns well-known companies such as Coles, Bunnings and Officeworks, while also holding interests in coal operations. Its performance has been strong for many years and it looks to be in a position to continue with its growth strategy.

Source 19.5a A short ASX tutorial on how to buy and sell shares. (03:12) © ASX Limited ABN 98 008 624 691 (ASX) 2014. All rights reserved. This material is reproduced with the permission of ASX. This material should not be reproduced, stored in a retrieval system or transmitted in any form whether in whole or in part without the prior written permission of ASX.

Government bonds and bank interest-bearing deposits

Should an individual not feel confident in investing in the stock market, a more comfortable financial management strategy may be to place their savings in government bonds or interest-bearing deposits with a bank. This should also form part of any individual’s financial management strategy. The Commonwealth of Australia issues bonds called Commonwealth government securities which are tradeable on the ASX. For investors they provide a predictable cash flow paid on a periodic basis (quarterly or half-yearly) and have a specified maturity date. The government also has exchange-traded treasury indexed bonds which have a face value that is adjusted for movements in the Consumer Price Index (CPI). Interest is paid quarterly at a fixed rate on the adjusted face value of these bonds. Accordingly, the amount of interest you receive varies from quarter to quarter.

All banks offer a range of interest-bearing deposits accounts. It is wise to compare what is being offered by the banks. Often they offer enticements for depositors as they are in the business of wanting to increase their market share in the financial sector. Many people are known to stay loyal to the bank where they originally opened their first bank account, but it is a good strategy to shop around for the best deal – it may not be with the bank you are with currently.

DEVELOPING YOUR UNDERSTANDING 19.3

You have received $50 000 as an inheritance from your grandparents and would like to invest this money in a term deposit for 3 years so that it will be available to you when you have finished school. You have been advised that you should place this money in a long-term deposit with one of the four major banks, as it will be safe and you won’t be tempted to spend the money straight away.

- Access the websites of the ANZ Bank, Commonwealth Bank, National Australia Bank (NAB) and Westpac, all via www.cambridge.edu.au/hass9weblinks.

- Construct a chart setting out the names of the banks, interest rates and any entry or exit restrictions on these accounts.

- Calculate and evaluate which long-term deposit account you consider would be the best alternative to meet your circumstances outlined above.

Managed funds

Using managed funds is a very popular and easy way for individuals to invest. It takes away many of the responsibilities and worries of the individual investor as a professional manager is employed to manage the fund. An individual investor deposits their money with the managed fund and these funds are then pooled together with other investors’ money. It is the role of the professional fund manager to investigate, research and invest in the assets classes which are currently performing best – shares, bonds, property and infrastructure assets. The individual investor is allocated a number of shares or units in the fund, which represents an equal portion of the fund’s value. The fund manager then monitors the assets on behalf of the individual investor and pays dividends or distributions from the fund based on the profit or income generated by the investments. Investing in one asset class alone can increase your level of financial risk; by investing in managed funds you are in fact reducing and spreading your level of risk.